Video Testimonial of H4P

HOME EQUITY CONVERSION MORTGAGE

TO PURCHASE PROGRAM

A Home Equity Conversion Mortgage (HECM) for Purchase Program, also know as a H4P, is a loan that allows homeowners age 62 and older to buy a home using a larger down payment to build the necessary equity in the home rather than using all their available assets.

H4P can increase your purchasing power, and make it easier to afford the home you want. The most important feature of this type of loan is that there is NO personal financial liability for the buyer(s), their heirs, or their estate for any loan balance that exceeds the value of the home when it is being sold to repay the loan.

H4P Eligibility Requirements Set by the Federal Government

- You must be at least 62 years old. (This applies to all co-owners listed on the home’s title)

- The home you are buying must be your primary residence and must meet FHA/HUD guidelines. Eligible properties are single-family homes and FHA- approved condominiums.

- You must have your down payment or “required investment” from an allowable source. While certain restrictions apply, these are generally funds you have had for at least 90 days or the sale of an asset that you already own. The most common sources of the down payment money are proceeds from the sale of a current home or money the buyer has in a checking, savings, CD, retirement or investment account.

Using the Home Equity Conversion Mortgage (H4P)

Reverse Mortgages are normally used by Seniors to remain in their homes while drawing money from their home. However, the Home Equity Conversion Mortgage for Purchase Program (H4P), are used by Seniors to purchase a new home with placing approximately 55% down.

With the H4P, the couple or the surviving spouse are in a position where No monthly payments are required*. In addition, Both Interest and Equity accrues over time and the balance of the interest is paid when the house is sold.

Just as with a traditional mortgage, any remaining equity at the time of sale goes to the homeowner or his or her estate. In addition, with a H4P loan, the owners are required to buy mortgage insurance. This assure the buyers and their heirs are free of any obligation if the value of the home is less than the interest accrued. This provides the buyers and their heirs complete peace of mind.

Purchasing seniors can typically borrow between 45 and 50% of the sale price up to the FHA maximum of $726,525. Loan to Value is determined by the age of the youngest borrower.

H4P mortgages are incredibly flexible borrowing tools. Seniors can choose to borrow the maximum allowed at closing or borrow less and leave a portion of the loan in a line of credit for future use. Interest is only charged on the funds drawn similar to a traditional Home Loan. Money not drawn in the line of credit is guaranteed to grow at the same adjustable interest rate that is being charged on the line of credit, even if the home value drops.

Seniors that are retired may have trouble meeting the new underwriting requirements for regular mortgages, which are primarily based on income and not assets; while reverse mortgages have much easier income and credit requirements. A H4P mortgage allows seniors the option buy a different home to better suit their physical needs, be closer to family, or move to a warmer climate.

The Benefits of the Home Equity Conversion Mortgage

- You do not give up title to your home.

- You make no monthly mortgage payments as long as you occupy your home as your primary residence, maintain your property, and remain current on the property taxes, homeowners insurance and HOA dues.

- No prepayment penalties.

- Although the loan is not due and payable until you permanently move out of the home, it can be paid off at any point without prepayment penalties.

- There is no time limit to how long the homeowner(s) may remain in the property. As long as one or both homeowners remain in the home as the primary residence and remain current on the property taxes, homeowners insurance and HOA dues, neither you nor your spouse will be required to leave or sell the home.

- You, or your heirs, retain 100% of the remaining equity upon the sale of the home.

Seeing Is Believing

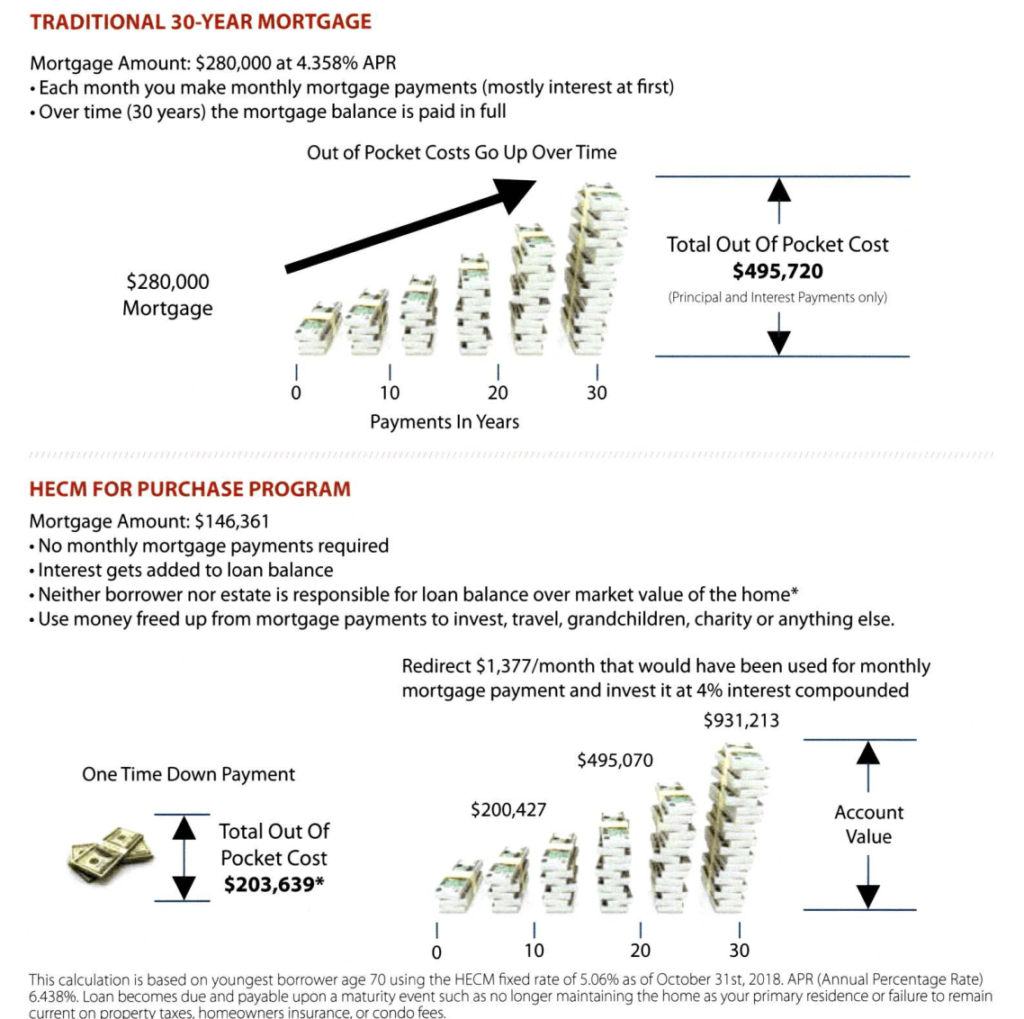

Remember Tom and Sarah from earlier? Before they learned about the H4P Program they were considering paying cash or securing traditional financing. They decided to use the H4P Program and purchased a home valued at $350,000 for a one-time payment of $203,639*a home valued at $350,000 for a one time payment of $203,639*. This left them with a loan amount of only $146,361.

One of the biggest challenges the H4P Program has is that it’s counter intuitive when compared to a traditional TRADITIONAL 30-YEAR MORTGAGE financing program. You’ve heard the saying “a picture is worth a thousand words” right? Well let’s make things so easy that you see the benefits of the H4P Program compared to a traditional 30-year mortgage. As you look at the diagrams below, carefully answer the following question: for every dollar that you remove from your pocket, what’s your return on that dollar?

*Borrower is responsible for property taxes, homeowner’s insurance, HOA and property maintenance in order for the loan to remain in good standing. A HECM is a home-secured loan that must be repaid upon default or a maturity event, such as when the home is sold, all homeowners have passed away, or the last surviving borrower no longer lives there as their primary residence.

Source Chris Bruser Retirement Funding Solutions – MyersLakeland.com – Myers Lakeland Blog is part of Century 21 Myers Realty that offers real estate services in Lakeland, Florida and Central Florida. We encourage you to share our content!